The importance of analytics during economic ambiguity

Brexit caused a whirlwind of economic confusion that shocked many when the results of the referendum were revealed on that warm summer’s morning of June 23rd 2016. It caused a shift in the British economy that solidified its uncertainty, and still we do not know what the outcome of the results will mean in the future. However, what we do know is that businesses are likely to suffer, which is why the need for analytics is crucial during a time of such ambiguity. So how can we be sure of analytics under uncertainty?

Consumers are spending less, because they have less

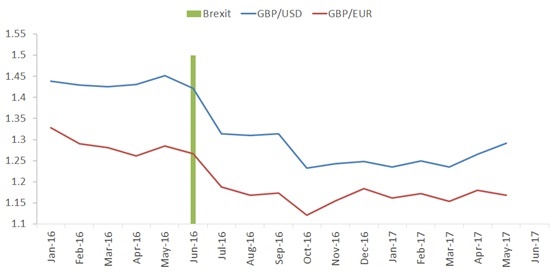

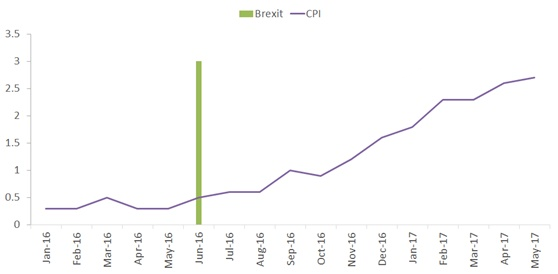

The GPB has devalued significantly leading to an increase in import costs and ultimately, an increase in price of consumer goods.

Chart: GBP vs the USD/EUR following Brexit

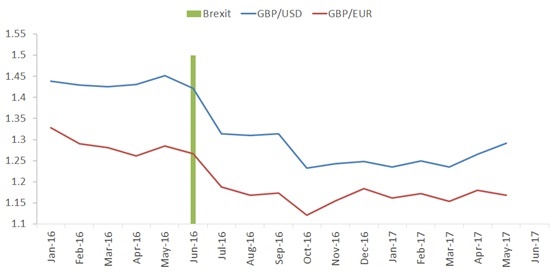

Inflation fired up to 3% this October, which is the highest it has been since 2012, unfortunately earnings only grew 2%. With the price on goods increasing and wages stagnating, living standards are suffering and this typically means consumers will get more price sensitive.

Chart: UK Inflation at its highest level for years

This particularly affects the FMCG and retail industry because people have less disposable income. High street retailers are also facing tough competition from online retailers such as Asos. Next and New Look were one of many fashion chains that were struck hard this year with a loss of £10.4m YTD Sep ‘17 compared to a profit of £59.3m during the same time frame of last year. This is likely to have alarm bells ringing for many brands with only six weeks to go before Christmas.

There is also the issue of the increasing rise of fuel and raw materials. In a bulletin from the Office of National Statistics, living costs have risen by 8.6% in comparison to 7.6% last year due to an increase in the price of food and airfares. Brands will have to minimise the effects of rising prices by increasing prices where they are likely to lose less sales and support key price points on important footfall drivers.

Price elasticities provide rescuing results

So how do we prevent businesses from taking heavy falls in the market? By measuring price elasticity in detail and on a frequent basis, you will know which product lines to increase price on (where the elasticity is lower), and which products to leave alone (where the elasticity is higher). This ensures that there is a minimal impact to the business in terms of lost sales, and can lead to increases in revenue and profit – despite the gloomy macro-economic situation.

At Brightblue we have launched a new automated predictive modelling product that can track and report price elasticity on a monthly basis. This can produce real time price optimisation results, which will ultimately save businesses significant amounts of money.

Clearly in unstable economic times there is even more need to understand what works and what doesn’t. By using data and sophisticated analytics, retailers are able to leverage this competitive advantage to help minimise losses and rise above the competition.

Brightblue Consulting are a London based consultancy which help businesses drive incremental profit from their data. We provide predictive analytics that enable clients to make informed decisions based on data and industry knowledge. Through Market Mix Modelling, a strand of Econometrics, Brightblue has a proven track record showing a 30% improvement in marketing Return on Investment for clients’ spend. If you are interested to find out more please contact us through email by clicking here and one of our consultants will get back to you shortly.