The role of branding in the Finance Industry

Traditional banking has become an industry filled with distrust and concern for many over the safety of their cash. However, there is a new age of banking emerging, the rise of the Fintech start-ups aiming to target the millennial market. This article explores how through the use of branding and marketing, digital banks are restoring our faith in this controversial industry…

Why is branding important?

Branding is useful as it helps consumers build familiarity and therefore trust in a company’s services. This in turn could help firms develop a competitive edge in the crowded financial services market.

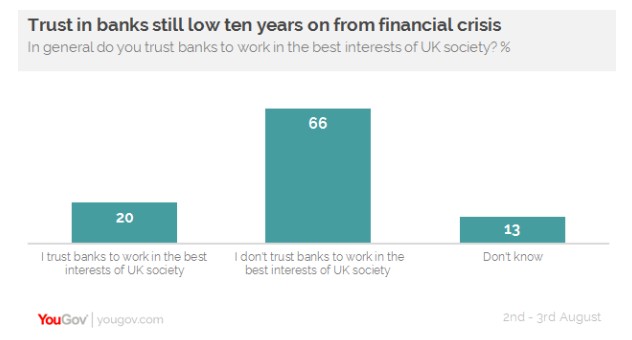

A decade on from the Great Recession, branding has become more important in the finance industry as consumer confidence remains low. This is highlighted in a YouGov survey (shown in Figure 1) where 67% of respondents believe banks ‘do not work in the best interests of UK society.’

Millennials are a particular market that have a lack of trust in banks, as according to CNBC, 45.3% of participants in the WEF’s Global Shapers Survey “disagree with the statement that they trust banks to be fair and honest”. As a result, this has created opportunities for Fintech companies to target this market with the aim of making banking more personalised.

Figure 1: Trust in Banks Survey (source: YouGov)

Challengers in Finance

A few challengers disrupting the industry include Habito (online mortgage broker est. 2015); Revolut (digital bank est. 2015) and Wrisk (online insurance provider est. 2018). As technology is changing the face of banking, trust is key for firms to establish a customer base. This is because in order for finance start-ups to survive, consumers need to have the utmost confidence in banks and brokers to handle their cash. This is especially considering that in the past consumers could rely on an in-store service to handle any issues, which is no longer available for Fintech firms.

Case Study: Monzo

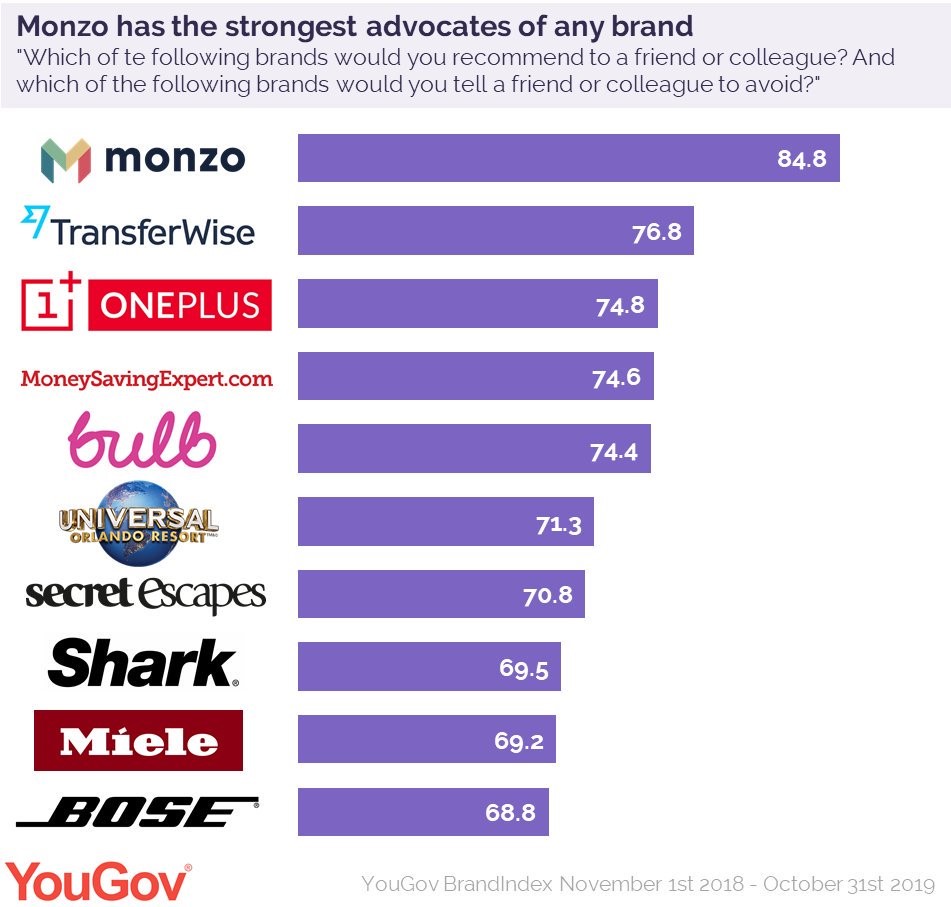

Monzo is a challenger bank who has seen a significant amount of success since 2015. This digital and mobile bank has established a customer base of 3 million and has the strongest brand support according to YouGov.

We are going to take a closer look at Monzo’s marketing strategy and the change to a traditional approach identifying the beneficial impact this had on the brand.

Monzo’s Crowdfunding Campaign

Monzo raised £20 million in the largest ever crowdfunding campaign which took under 3 hours and saw 35,972 members investing according to Which? . The campaign was such a success because consumers recognized that the money raised was invested back into the company to develop loan products (and future R and D) hence having a direct benefit for members. This supports Monzo’s mission of “making money work for everyone”.

Monzo’s switch to traditional marketing

Unusually, 80% of Monzo’s marketing has been through word-of mouth, using commuting meet-ups and hackathons according to Marketing Week. However, the company has had success branching out into a more traditional approach using YouTube ads on Facebook and Google.

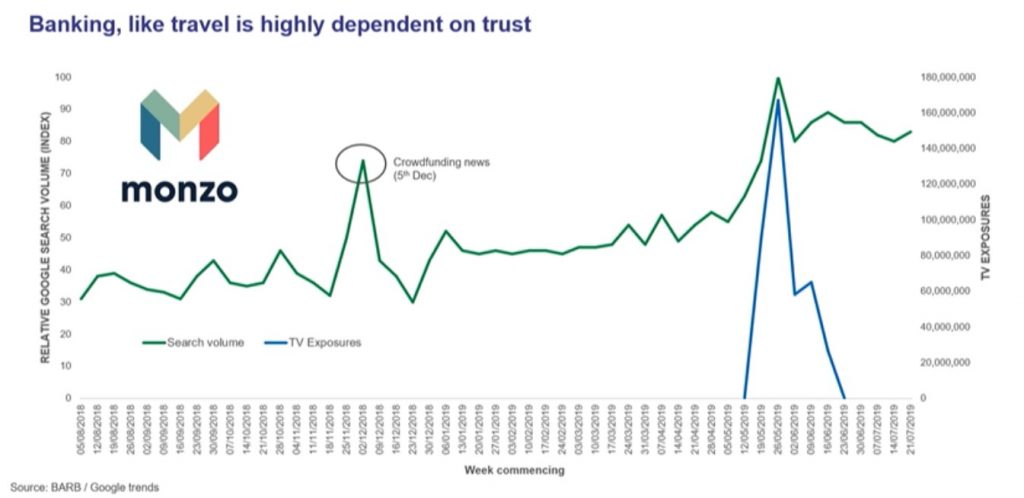

Additionally, the recent TV advert that Monzo produced in May had significant success with a rise in 100,000 sign-ups in June and a rise in brand awareness from 35% to 48%, a 13-point increase according to Marketing Week. This meant that considering the TV campaign was Monzo’s first with the aim to expand the target market from being ‘95% male and 100% iPhone-owning’ in 2015 (according to the Guardian) to an older audience it worked extremely well shown on Figure 3 below.

Figure 3: Impact of crowdfunding and the late May TV advert on Monzo’s performance (source: BARB/Google trends)

To conclude, we can see how Fintech companies have been able to take advantage of a decline in support in traditional banking and through combining a range of traditional and modern marketing they have generated consumer confidence and loyalty. As technology continues to evolve it seems that the new age of banking has endless possibilities…

The Brightblue team have decades of experience helping clients understand media efficiency by truly digging into the drivers of sales and revenue. We have experience across automotive, retail, travel, entertainment, telecoms, FMCG, white goods, financial services, health and many other sectors. Our unique way of modelling the entire client journey truly helps marketeers understand what they can do to shine in their organisation by driving business and making a real difference to their bottom line. Get in touch if you have any questions on this article or any of the ways Brightblue can help.