UK Economic Recovery post COVID

What are the latest trends in Consumer footfall signalling?

Where are we now and how did we get here?

The coronavirus pandemic has had a severe impact on the UK Economy with GDP falling by 20.5% in April as government restrictions on movement significantly reduced economic activity. With all areas of the economy hit; the UK economy was about 25% smaller in April than it was in February.

As lockdown measures start to ease and we venture towards a new normal there appear to be early signs of recovery. Using geo-data from Huq Industries in the UK and around the world we explore what this may look like for the UK.

Unprecedented fall in consumer confidence

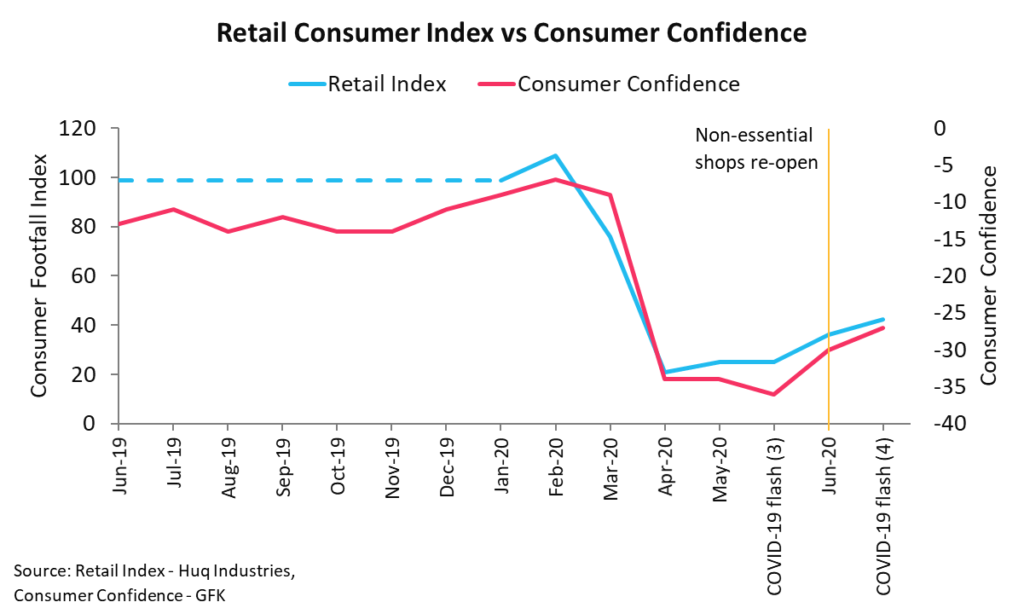

With non-essential stores forced to close shop towards the end of March, we saw retail footfall drop by 68% and consumers shift their purchases online. Online sales have been steadily growing through the pandemic with June seeing a 53.6% increase in volume sales when compared to February 2020. Despite this increase in online purchases, total consumer spend has fallen as the implementation of lockdown resulted in lower consumer confidence and the consumer confidence index falling to a record low of -36 in April.

As restrictions on movement start to loosen across the UK, June saw a 6-point increase and July a further 3-point increase in consumer confidence as consumers appear to be slightly more optimistic about future perceptions of personal finances and the economy.

The recovery is slower than the fall

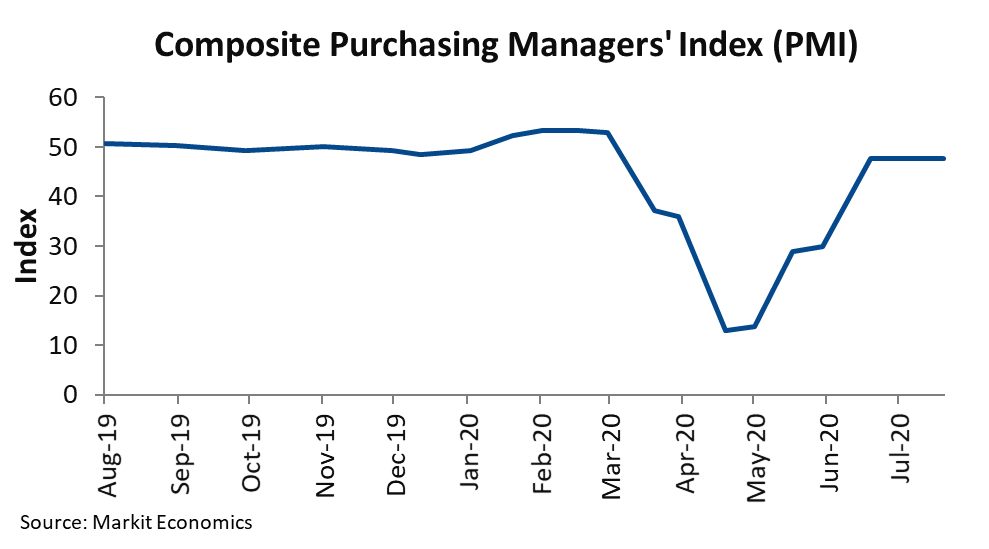

June also saw the slump amongst UK companies level off as the economy started to reopen following the easing of lockdown measures. The UK’s Composite Purchasing Managers’ Index (PMI) rose to 47.4 in June from 30 in May. This value is still below the 50 threshold for growth, but this has been encouraging news as service providers have reported an expansion of new business over the month of June. This has been commonly attributed to pent-up demand as well as the phased restart of the UK economy.

With non-essential shops allowed to re-open from 15th June and pubs and restaurants from July, we have begun to see an upward trend in retail footfall in line with increasing consumer confidence. However, consumers appear to be cautious in returning back to retail environments.

4 months to recovery

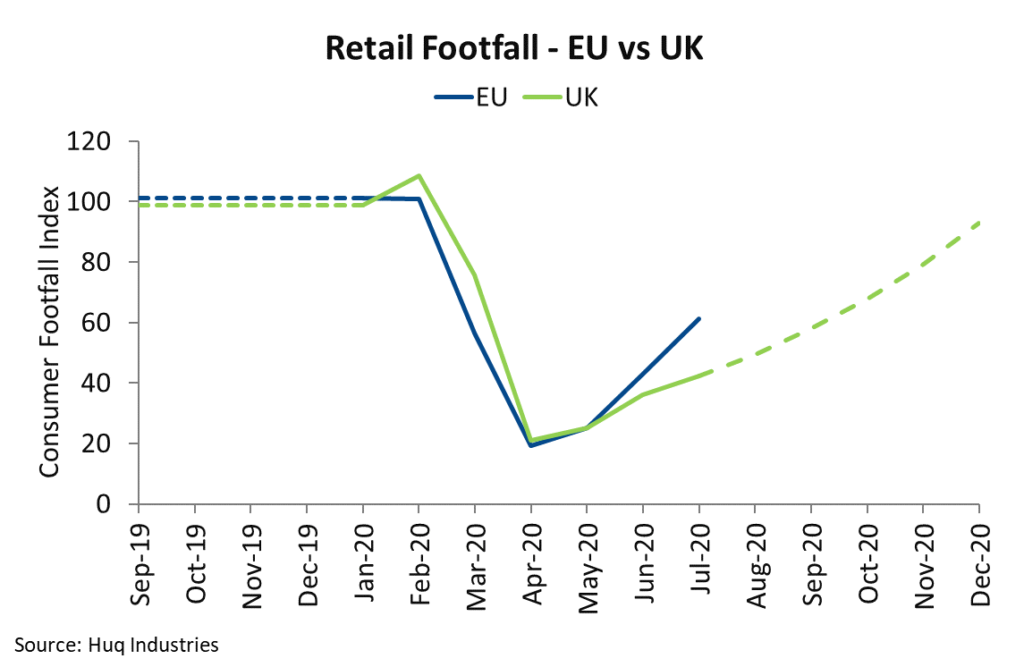

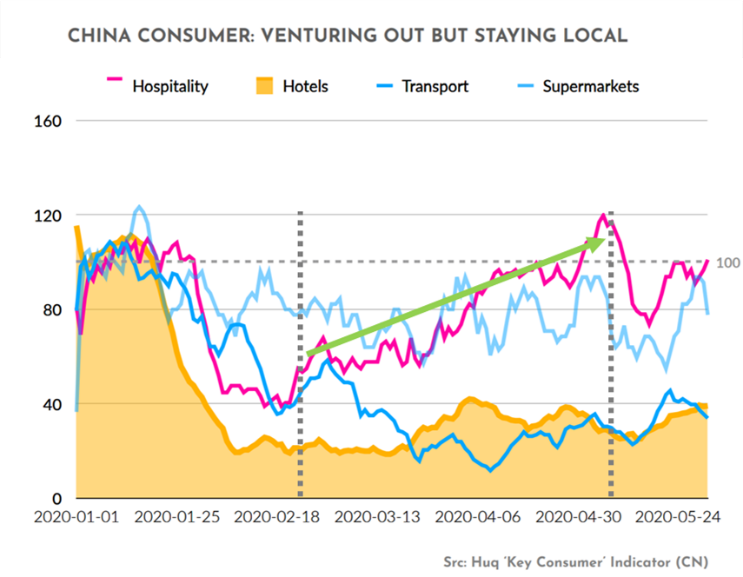

An average 20% month-on-month increase in footfall has been seen across Europe where lockdown restrictions were lifted a month prior to that in the UK. If the UK follows a similar trend to that seen in Europe, we expect the UK to take on average four months to recover to pre-COVID levels once restrictions have eased. With China being the first country to exit lockdown, using Hospitality as a proxy for retail we saw recovery take about 3 months to reach pre-lockdown levels as seen in the chart below.

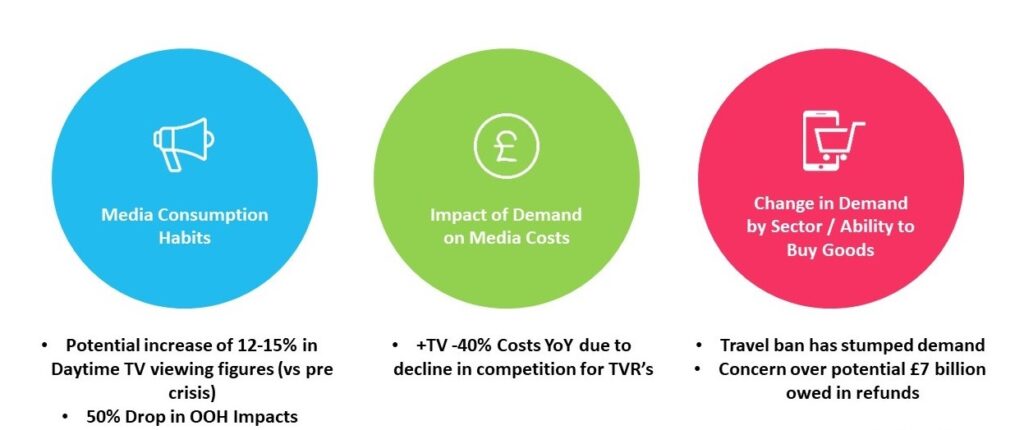

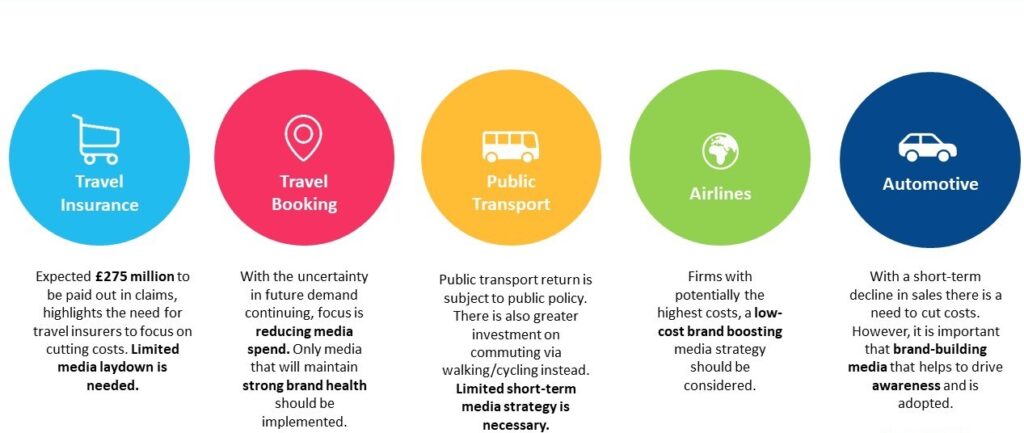

Longer term pain for international travel & hospitality

Whilst this is encouraging news for the retail sector, the travel and hospitality sector continues to lag behind. Early indicators signalled that consumers were starting to venture out but choosing to stay local.

Following the announcement that the hospitality sector would be able to re-open, several holiday booking websites saw a surge in online traffic. They also saw a 170% increase in bookings with over 50% of those bookings being staycation reservations made for July. This is welcoming news for the recovery of local tourism.

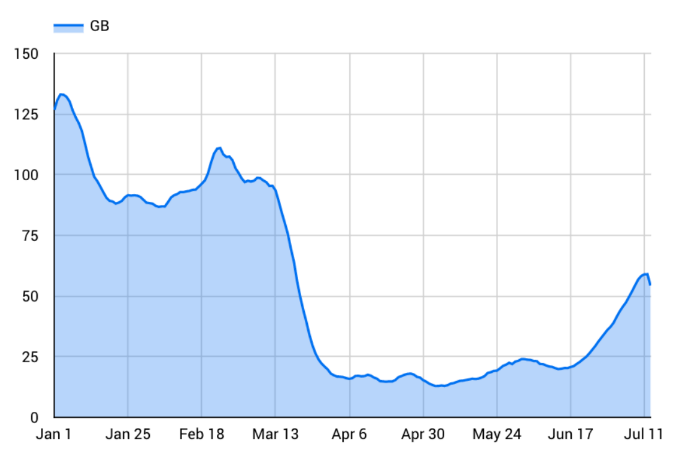

European Travel Indicator for GB Residents

Outbound tourism from the UK fell to about 15% of pre-lockdown levels in April. With the government’s relaxation on the 14-day quarantine rules for returning travellers from certain European countries, July saw an increase in the number of British tourists travelling to European destinations with numbers recovering up to 59% of pre-lockdown levels.

Important to note that this still only constitutes to 38% of 2019 levels with recovery difficult to predict given the dynamic COVID situation.

UK tourism and hospitality recovery lagging behind Europe

Whilst there appears to be slow uptake of outbound tourism, comparisons by the FT using data from Huq’s European Travel Monitor shows that the recovery of inbound tourism to the UK is lagging behind other European countries.

Inbound visits to the UK was forecasted to grow by 2.9% and spending by international travellers to increase by 6.6% in 2020. Following the coronavirus pandemic, revised short term forecasts for 2020 by Visit Britain based on the assumption that there will not be a second wave of the virus, now estimates inbound tourism will decline by 59% in visits and 63% in spend. Whilst tourism numbers are forecasted to gradually rise through the remainder of 2020, this will still be significantly below normal levels by the end of the year.

Similarly, revised forecasts of domestic tourism suggest a 48% decline in consumer spending as social distancing measures to ensure venues can operate safely will limit capacity and mean businesses will be operating sub-economically. In addition to financial support other measures the government can take to support the tourism industry include cutting tourism tax by 10% to encourage domestic tourism and lowering Air Passenger Duty to boost inbound tourism as well as constantly reviewing countries with “air bridges”.

Summary

- Easing of lockdown measures has seen consumer confidence increase month on month, with consumers more optimistic of the future

- Similarly, the UK’s Composite Purchasing Managers’ Index (PMI) rose to 47.7 in July and is forecasted to rise even further to 57 in August, suggesting an expansion in the sector

- Since June 20, the UK retail footfall index increased by 20% over the month after non-essential stops were allowed to re-open. Similarly, MoM growth has been seen across Europe. If momentum is continued, we expect Retail footfall to reach pre-COVID levels in 4 months.

- There has been an increase in demand for staycations in the UK with many preferring to travel locally; however, due to social distancing rules which have limited capacity, total consumer expenditure is expected to decline.

- Domestic travel is likely to recover faster than international and business travel. However, this will still be a lengthy process due to uncertainty and fears of a second wave of the pandemic, supply loss, some continued level of social distancing and a decline in traveller sentiment.

With a majority of shops and restaurants now open, measurement to understand and quantify the impact of COVID and marketing will be important. Regular updates will also allow brands to continuously monitor the new landscape in which we operate and optimise media investment to be more efficient and effective. With 9% of the UK’s GDP generated by tourism the long-term health of the travel and hospitality industry is of utmost importance. To aide recovery more consumers should be encouraged to holiday at home with marketing campaigns having a greater focus on domestic travel. In order to attract international tourists, the industry should use this as an opportunity to drive innovations and boost the UK’s profile as a prime holiday destination.

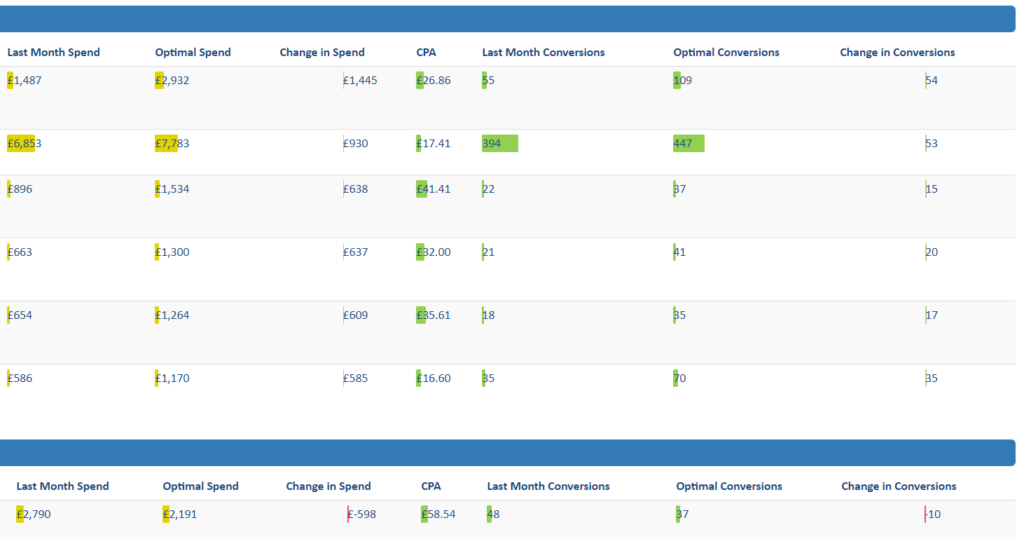

Brightblue are leading independent thinkers, growing the performance of businesess through exceptional predictive modelling. Due to the current crisis, we are offering a free clinic to clients, giving help and advice on how to:

- Optimise your media plans, using our benchmarks on lower spend for the lockdown period and larger spends for the bounce-back.

- Move marketing spend to drive returns in online channels.

- Ensure media plans are set up in the right way to measure uplifts when sales recover.

- Set up media evaluation tests to measure unused media in the down period.

- Choose the right KPI to track growth and help forecast demand for when restrictions are lifted.

Please reach out to Brightblue at info@brightblueconsulting.co.uk to set up a short session with one of our senior team