How Can Brands Harvest Competitor Demand on PPC?

We’re all familiar with searching for a brand name online and finding the first result that shows up is an advert for their competitor. It’s common for a reason, as done right it can be a cost-effective way to harvest demand generated by competitors. In this article, we’ll explore some important considerations for harvesting competitor demand through PPC effectively.

Why can harvesting competitor demand through PPC be cost effective?

If a competitor brand is advertising successfully, they’ll be driving more consumers to search for their brand terms online. If we can convert those searches towards our website at that moment in time, we’re effectively using the outcome of competitors marketing spend to drive more demand for our own brand.

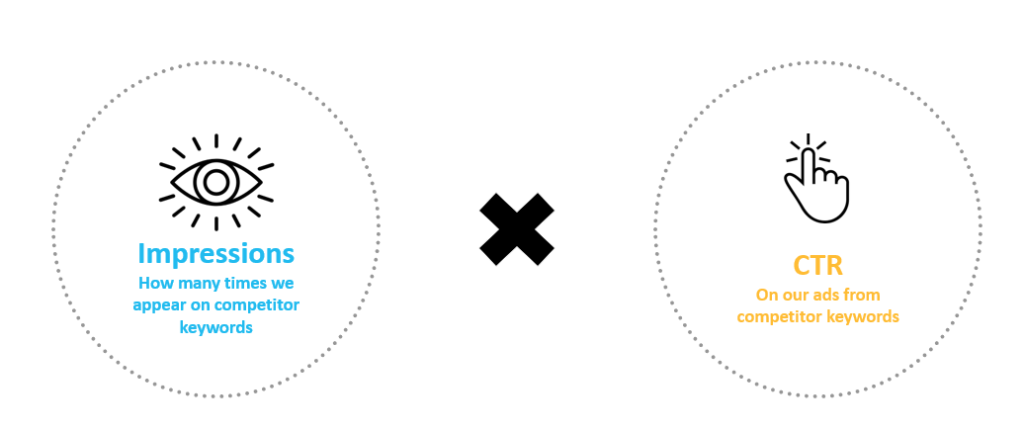

What intermediate metrics do we need to consider?

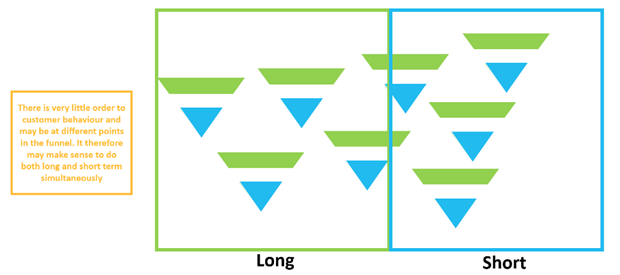

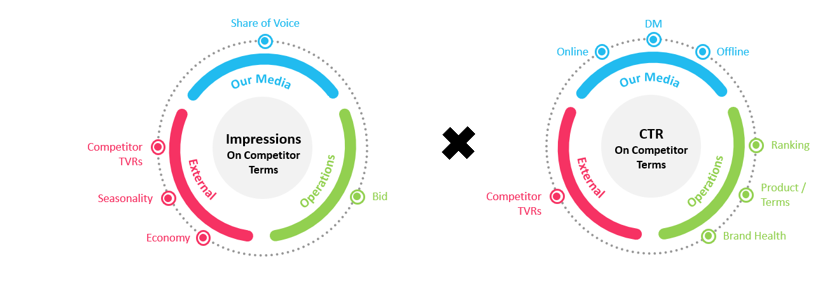

To effectively harvest demand through paid search, we need a high number of impressions coming through that competitor’s terms, as well as a high CTR (click through rate) on our search ad. If both of these are high at the same time then, in general, we’ll be converting a high volume through brand search terms onto our website.

However, these metrics are driven by very different factors. For example, impressions on competitor brand terms are mostly driven by that competitors own marketing activity and seasonal demand. Conversely, our own CTR on that competitor term is driven by our own marketing activity (consumers are more likely to click through when they’ve seen our own advertising) as well as our search term’s ranking.

So, with this in mind, how can we harvest competitor demand more effectively?

Tip #1: Consider the Big Picture

As demonstrated above, Brand PPC performance is dependant on a lot more than just our within channel changes. We need to ensure we’re supporting PPC with other media channels in order to allow our competitor terms to harvest competitor demand most effectively.

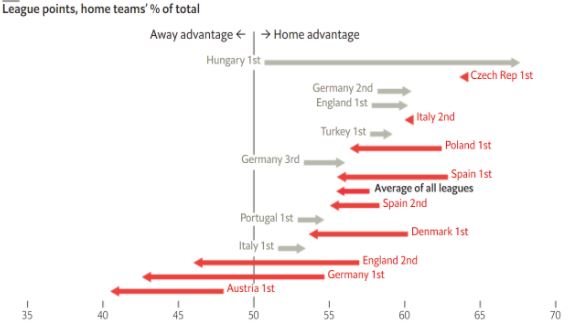

Tip #2: Align channels which are effective at driving CTR increases with competitor media bursts

When competitors are on TV, this drives more demand through their search terms. This means if we can align our other media spend to drive a higher CTR at the same time as competitor activity is live, our marketing will be working harder for the same cost (because that CTR uplift is applied to a higher number of impressions).

In the example below, Display drove more sales through competitor search terms when it was run alongside competitor TV activity (for the same cost).

*This graph shows at the uplift through competitor PPC terms only. Its important to also consider the impact of flighting channel activity through any other sales channels (such as direct to website), which your modelling provider should be able to report. This will give you the best plan overall for optimising marketing profitability.

Tip 3: Test! Test! Test!

The best models are built on testing and learning. If you haven’t done much competitor PPC activity in the past, or are nervous about the potential of high cpcs (cost per clicks), consider ring-fencing a small budget to begin with. With the right post-campaign evaluation, which considers the impact of external and other marketing factors, you can accurately understand the ROI of this smaller investment and build confidence to spend more where appropriate.

In Summary…

It’s important to consider all the factors which drive effective PPC performance. Whilst automated bidding can drive significant within channel improvements, we also need to be considering our whole marketing laydown in one holistic measurement to understand how different channels (such as ATL media and PPC) can complement each other and work harder than the sum of their parts.

We work with brands to model the drivers of sales generated through competitor search terms. This allows us to make evidence-based recommendations on budget levels and optimising marketing laydown to drive more profit from marketing.

Brightblue Consulting are a London based consultancy which help businesses drive incremental profit from their data. We provide predictive analytics that enable clients to make informed decisions based on data and industry knowledge. Through Market Mix Modelling, a strand of Econometrics, Brightblue has a proven track record showing a 30% improvement in marketing Return on Investment for clients’ spend. If you are interested to find out more please contact us through email by clicking here. One of our consultants will get back to you shortly.